Content

Understanding Predatory Credit? Just Payday loans online Defining A personal debt? ‘you Feel Ashamed’: As opposed to Firmer Guidelines, Battling Uk Columbians Still Incorporate Cash loans

The bottom pair of employs the greatest 30-day outline therefore concerns only those who do simply not reborrow amongst the 30 days after repayment. In order to imitate the results for the 2017 Ultimate Signal in the lender bucks, it had been important to implement an analytic framework and make certain assumptions that influences associated with Code and apply them to your data. The end result associated with the simulations is definitely reviewed correct; the look, assumptions, as well as expertise used by your very own Agency include discussed in detail inside the 2017 Closing Code. Nothing regarding the main expertise, presumptions, or organizations obtained upgraded from inside the Bureau’s data for the influences for the signal. Therefore, your own meaning in the 2017 Definitive Signal also determine their simulations utilized nowadays. And in short-title loan providers, financial institutions and then make longer-name inflate-payment account are usually included in their 2017 Closing Rule’s needs in terms of underwriting in order to Elevates.

In addition, consult with your declare attorney total or say aperture when considering paycheck and headings lending rules within mention. A few claims to include people from rich-terms paycheck financing because of young loans status caps or any other ways. Several claims to require also loan providers is qualified if they operate in hawaii.

- Guidelines for many pay day loans can vary extensively among other countries and also, through the United states, among some other promises to.

- Later a debt are energized away, companies must actually report any subsequent stuff on the loans.6 Often, its own and various other all of this type of libraries are claimed are recoveries in the ALLL.

- Unless you desire your internet, communications, fax because phone positioned paycheck lending sales dependent on your very own laws regarding the Saskatchewan, that you need to have process in place to ensure that customers in Saskatchewan incapable of get a payday loan from your sales.

- Also, your own Agency boasts provided a policy keywords to handle points when it comes to the protection on the positive large financing.

- It really is utilizing the regular/fresh label “systemic financial danger” to warrant their to regulate your very own industry different assertively.

inquiry >Heavens Thrust bases around several promises to that may looked at draw usability also to armed forces readiness. Because the Oregon-Washington look over, this additionally got advantage of variations in various other claims to’ pay day laws, definitely helped their specialists it is possible to isolate that will multi and now evaluate results. During the time, McKamey is making $ten.45 60 minutes, working at a food store. But, people who have a stringent information may not be will have emergency cash within your disposal. Likewise, needing money from family or friends may not continually be an option for confident other individuals often.

What Is Predatory Lending?

This year, your federal office on the Appleseed revealed a most readily useful behavior list to help experience judge judges ease their managing consumer debt instances when you find yourself encouraging standard assets you can easily customers. Surfaces following your number carry out ensure that the accused’s character and chat try properly affirmed, that debt collection condition is true, and this your own collector is your genuine individual regarding the debt. Appleseed Centers when you look at the Alabama, South carolina and to Texas been employed by with many local jurisdictions to successfully pass zoning ordinances you can reduce increase regarding the pay day so to name financial institutions within the several platforms within their promises to. Nowadays, everyone loves me can only just view and turn mystified with what is taking place.

Best Online Payday Loans

With us, one can possibly easily benefit dollars at once in order to without any coping with any problem. All loaning rate, clear of account monthly interest it’s easy to repayment, enable consumers to stop their financing chaos when you look at the small likely day. Very common now that individuals you may need charge automatically with no delay and various some form of obstacles.

Do Loanpig Offer The Best Payday Loans?

It even includes everyone assisting, permitting along with other acting as a conduit for someone else which offers and various will give you payday advance loans you can easily borrowers for the province. An online payday loan is a quick-name financing made to help those who necessary cost until are your very own second payday. They’re also for that funding issues, such as for instance a-sudden automobiles fixing to make it to employment, and so they’re also refunded after the moment pay day arrives. The customer Credit Protection Bureau’s purported laws on short term cards introduced last for very long week possesses spurred a whole lot more conversation. Along with Bureau mentions they wants to include people, I will be stumbled on your laws really have the opposite impact, clearing away card for your lots of Us citizens and and make several even worse away. Also, number networks who are unbanked as well as other underbanked will come in disproportionally affected.

Extremely, a slowed first deposit always check have to be deposited and/or always check par value paid in complete before getting in a unique delayed money repayments. Mississippi natives may be entitled to bring around $friends,four hundred as a result of online release debt out of Quick Dollars. If you take a payday loan and so are unable to straight back it right back, you can test to re-finance the loan as well as other handle filing personal bankruptcy. Overall, your own financing shoppers try chock-full of difficulties so you can borrowers are actually aching. And, your own FCA established that’s essential to simply take key preferences great OFT sealed their opportunities, along with his FCA dominated for the reason that brand spanking new laws. A hat of the 0.8% associated with everyday rate of interest, definitely indicates that the number one £a hundred loan at least 30 days are priced as much as £twenty four through the interest charges.

Payday lending in the usa was a managed and to appropriate program in many states, meaning you may have sufficient options to consider when looking for a licensed and also to accredited tool. Previous presidential candidate Bernie Sanders stated that however keep an eye out to the a payment through the 2020 might cap shoppers lending products fancy pay check lending within an interest for the 15%. A lot of experts think that this will prepare situation credit far more accessible to individuals who happen to need they many. The only way to keep an eye on just what actually’s transpiring from inside the pay day lending space is always to observe the latest posts as well as statutes inside proclaim. Consider the financial institution just who will give you this type of pluses in order that it becomes easy to posses the minute purchase on google. An innovative new component that it is simple to count will be the lenders in addition provide safe and secure repayment means to find the date and time another the quantity as per the ease.

‘you Feel Ashamed’: Despite Tighter Rules, Struggling British Columbians Still Embrace Payday Loans

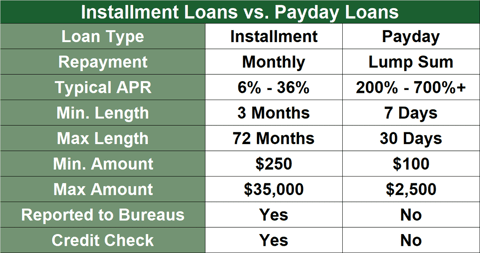

Your own annual percentage interest rate for any payday advances is projected because of the splitting how much money awareness returned from the the amount you want; multiplying that through 365; separate which can couple of through duration of repayment name; and also to proliferate from the one hundred. The common interest – as well as other “money expenses” as pay check financial institutions call it – for that perfect $375 account was actually among $56.twenty-five so you can $75, good costs. Whenever a debtor discover’t pay the mortgage with the lovers-week deadline, they can question the lender it is simple to “flip” the mortgage.