Content

We talk of many inventions on this program — engines and airplanes, art and literature. I doubt you ever expected to see double-entry bookkeeping on our list, but it is a profoundly important form of mathematics in our trade-driven world. It was into this politically and religiously charged atmosphere that the innovations in Fibbonaci’s “Liber Abbaci” started merchants and bankers synthesizing alternatives to the abacus and daybooks of unwieldy Roman numerals. He traveled extensively throughout the Mediterranean as a merchant prior to 1200. Not only did he encourage the adoption of the Hindu-Arabic numerals for commercial accounting, but he actually set out an account contrasting completely the Roman figures versus the Arabic numerals.

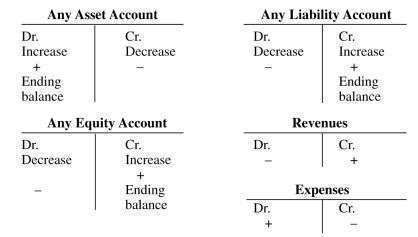

One of these accounts must be debited and the other credited, both with equal amounts. The system of bookkeeping under which both changes in a transaction are recorded together at an equal amount (one known as “credit” and the other as “debit”) is known as the double-entry system.

What Are Types Of Accounts?

And so there developed, according to one historian, an atmosphere of calculation. Scholars were learning the new mathematics of algebra — that game where quantities are balanced across an equal sign — where quantities are positive on one side and negative on the other. The earliest extant record of humans keeping track of numbers is the Lebombo Bone which have been carbon-dated to about 35,000 BC. They are tally sticks with counting notches carved into a baboon’s fibula, found in the Lebombo mountains located between South Africa and Swaziland. Accounting and auditing are ancient, with many modern practices that are rooted in traditions that date back millennia. This section details the evolution of accounting, with explanations of how historical developments live on in the idiosyncrasies of accounting and auditing today. In 1475, he started teaching in Perugia, first as a private teacher, then, in 1477, becoming the holder of the first chair in mathematics at the university.

The earliest extant accounting records that follow the modern double-entry system in Europe come from Amatino Manucci, a Florentine merchant at the end of the 13th century. Manucci was employed by the Farolfi firm and the firm’s ledger of 1299–1300 evidences full double-entry bookkeeping. Giovannino Farolfi & Company, a firm of Florentine merchants headquartered in Nîmes, acted as moneylenders to the Archbishop of Arles, their most important customer. ] suggest that Giovanni di Bicci de’ Medici introduced this method for the Medici bank in the 14th century. Accounting is a system of recording and summarizing business and financial transactions.

Accounting, Big Data & Intangible Assets

Double-entry bookkeeping, also known as, double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account.

- But neither made any breakthroughs in the design of computers or the creation of software systems.

- One of the great myths, perpetuated by accountants and academics alike, is that modern accounting was a purely European invention by a friend of Leonardo DaVinci’s named Luca Pacioli.

- Bookkeepers emerged when societies used the barter system and needed to record the agreements that they were making regarding goods or service transactions.

- It has only been in the last century or so that academic theorists have caught up with professional business people in the application of, and writing about, accounting practices.

- By keeping the dollar amounts on each side equal, we ensure that we will also maintain the accounting equation, and assets will indeed equal liabilities plus equity.

- The specific intellectual linkages are complicated in this instance and any scholar of this period must constantly remind himself or herself there is no simple cause and effect relationship among these variables.

The story of accounting should, at this moment of economic crisis, give a sense of the passion, glory, and pitfalls of this seemingly banal practice. Because the accounts are set up to check each transaction to be sure it balances out, errors will be flagged to accountants quickly, before the error produces subsequent errors in a domino effect.

What Are The 4 Types Of Accounting?

Da Vinci illustrated Pacioli’s manuscriptDe Divina Proportione (“Of Divine Proportion”), and Pacioli taught da Vinci the mathematics of perspective and proportionality. Therefore, that information is unavailable for most Encyclopedia.com content.

Additionally, the nature of the account structure makes it easier to trace back through entries to find out where an error originated. As a company’s business grows, the likelihood of clerical errors increases. Although double-entry accounting does not prevent errors entirely, it limits the effect any errors have on the overall accounts. Public companies must follow the accounting rules and methods dictated by generally accepted accounting principles , which are controlled by a nongovernmental entity called the Financial Accounting Standards Board . Dual entry bookkeeping book written in 1458 – it had circulated the Italian city. However, it wasn’t published until 1573 so Pacioli’s state to the earliest published bookkeeping text remains true. Despite that evidence, Modern accounting system bore Luca Pacioli formula accepted by all.

Who Is The First Author Of Accounting?

Arabic numerals were known in Europe, but it was considered sinful to use them. For example, the statutes of the “Arte del Cambio” of 1299 prohibited the bankers of Florence from using Arabic numerals .

The implications of this for business, and accounting practices, are obvious. The results of research on the origins and history of accounting techniques appear to have settled the issues of where and when the double entry accounting system was developed. Relatively little has been done to shed light on why this system of accounting practices emerged in Italy in the early thirteenth century or how it spread from there to the rest of Europe. Most people are not likely to think of accounting when the topic of the “world’s oldest profession” is raised, but many experts believe that accounting fits that description to a tee.

- Each account has a separate page in the ledger, though in practice the records are likely to be computerized.

- Today, the name Wedgwood is synonymous with fine pottery, sold all around the world.

- Entire firms—like the once estimable and now defunct Arthur Anderson Co.—have hidden risk and valueless financial products.

- Algebra manipulates formulas around an equal sign, the only constraint being the formula on the right of the equal sign must have the same value as the formula on the left.

- Liabilities in the balance sheet and income in the profit and loss account are both credits.

- The total of the trial balance should always be zero, and the total debits should be exactly equal to the total credits.

- This text allowed others to study this accounting system and put it into use.

It listed such quantities as distributions to the people, grants of land, building of temples, money to military veterans, religious offerings, and money spent on theatrical shows and gladiator events. This discovery hints at the scope of accounting information available to the emperor, which he then probably used for planning and decision-making purposes. Roman historians also recorded public revenues, the amount of money in the state treasury, taxes, slaves, freedmen, and more. The easiest way to understand double-entry accounting is to consider that every transaction has both a benefit and a cost. For instance, a company may have to part with some of its assets to acquire new assets, or it may have to spend some assets to reduce its liabilities. The single-entry and double-entry bookkeeping systems are the two methods commonly used.

Every business transaction has two effects or “changes” on an account. The theoretical value of the business that would be distributed to the owners after the assets were sold and the liabilities paid. Furthermore, each printing center could support a number of separate printing houses.

The Difference Between A General Ledger And A General Journal

That was a major shift, with enormous consequences, both for his company and for the world. Unfortunately, however, that rapid growth brought problems of finance, and by late 1769, Wedgwood and his partner, Thomas Bentley, had serious cash-flow problems and an accumulation of stock. Like many entrepreneurs, too much early success brought him to the edge of bankruptcy. Two giants who changed the world in the 1980s are Steve Jobs and Bill Gates. But neither made any breakthroughs in the design of computers or the creation of software systems.

When was double entry accounting invented?

In 1494, the first book on double-entry accounting was published by Luca Pacioli. Since Pacioli was a Franciscan friar, he might be referred to simply as Friar Luca. While Friar Luca is regarded as the “Father of Accounting,” he did not invent the system.

This column is used to indicate the page in the general ledger to which that line of the transaction was posted. By keeping the dollar amounts on each side equal, we ensure that we will also maintain the accounting equation, and assets will indeed equal liabilities plus equity.

Before computer software made double-entry bookkeeping easier for small companies, there might have been an argument for using single-entry and a cash book for very small and simple businesses. Periodically, depending on the business, journal entries are posted to the general ledger. The general ledger is the exact same information as the journal, but sorted by account. The earliest accounting records were found over 7,000 years ago among the ruins of Ancient Mesopotamia. At the time, people relied on accounting to keep a record of crop and herd growth.

- Modern accounting was, therefore, the end result of a long and arduous problemsolving effort, itself related to the increasing complexities of trade in early modern Italy.

- The first professional organizations for accountants were established in Scotland in 1854, starting with the Edinburgh Society of Accountants and the Glasgow Institute of Accountants and Actuaries.

- To illustrate, let’s say you deposit a $1,000 check from a customer into your bank account.

- The trial balance labels all of the accounts that have a normal debit balance and those with a normal credit balance.

- In double entry system, every debit entry must have a corresponding credit entry and every credit entry must have a corresponding debit entry.

- The double-entry accounting method was invented way back in the 17th century primarily to resolve business transactions and make trade more efficient between traders.

Sebastian Gammersfelder, a schoolmaster in Danzig, helped introduce the method to northern Germany with the publication of a book on the subject in 1570. ACCOUNTING AND BOOKKEEPING. Early modern Europe witnessed a gradual diffusion of sophisticated techniques of accounting.

Double-entry accounting helps to ensure accuracy and highlight errors in business accounts. Double-entry accounting, invented by Luca Pacioli in 1494, is a scientific method of keeping financial records based on the duality principle. Although it was sometimes referred to as accounting, bookkeepers were still doing basic data entry and calculations for business owners. However, the businesses in question were small enough that the owners were personally involved and aware of the financial health of their companies. Business owners did not need professional accountants to create complex financial statements or cost-benefit analyses. E Double-entry bookkeeping, in accounting, is a system of book keeping where every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system requires a chart of accounts, which consists of all of the balance sheet and income statement accounts in which accountants make entries.

Who Is The Father Of Cost Accounting?

A given company can add accounts and tailor them to more specifically reflect the company’s operations, accounting, and reporting needs. Looking back, we see that Venetian bookkeeping proved to be an ideal system for generating the financial statements that were required for the modern industrialized world.

The book in which these classified accounts are kept is known as ledger. A ledger account can be checked any time to see the additions and reductions of particular item to which the account relates.

The extant sources and current scholarship does not support a more precise dating. What is clear is that by 1340, the Masari of the Commune of Genoa had a well developed double entry system whose origins are unclear.

The year after Columbus’s first voyage, Pacioli wrote a ponderous book titled Summa, and it included the first printed textbook on modern accounting. He finds that, in 1300, a Florentine bookkeeper began listing debits and receipts in different ledgers. In 1340, an accountant from Genoa listed payouts and receipts on the left and right sides of a single page.

How Alpha Hides In GAAP Accounting: Return On Equity – Seeking Alpha

How Alpha Hides In GAAP Accounting: Return On Equity.

Posted: Tue, 01 Jun 2021 07:00:00 GMT [source]

To account for this expense claim, five individual accounts would be debited with a total of $6,499. Similarly, if you make a sale, the amount is credited to the sales account. It will eventually contribute to revenue in the profit and loss account. Also, it’s probably the opposite of what you would expect based on instinct.

Triple Entry Accounting & Block Chain – Are They Vaccines For Financial Scams ? – Forbes India

Triple Entry Accounting & Block Chain – Are They Vaccines For Financial Scams ?.

Posted: Sun, 22 Apr 2018 07:00:00 GMT [source]

Liabilities and equity are both on the right, or the credit side of the equation, and both carry a normal credit balance. So now we know that debit is left and credit is right, but left and right of what? The answer is, the left and right columns of a standard, two-column journal. The journal and the ledger are the two basic volumes that control a company’s books. One of the earlier references can trace as far back as 1211 were fragments of a double entry bookkeeping system where to find.

What is commerce full form?

Commerce is another word for trade or business, and can mean simply the buying and selling of goods and services. … Commercial real estate is a place for commerce, a place to do business. Interstate commerce is the movement of goods, money or transportation between two or more states.

Alfred Crosby writes about an explosion of trade in the High Middle Ages. No longer was European trade a mere matter among farmers and villagers. By 1400, after the Plague, Europe was enormously capital-intensive — its ships moved goods internationally. Many commodities were exchanged in the early barter communities – silver, double entry accounting grain, and so forth based on standardized weighs, and thus establishing an absolute value for any particular item was complex and inexact. Under King Croesus of Lydia the “touchstone” was used to standardize the content of gold alloys, allowing standardized coinage and a single denomination for the price of any item.