Content

Would you Quit Your house Wearing a Segment thirteen Bankruptcy proceeding? Become A duplicate Of the Credit file Trying to find Beyond Payday loan Period? Occurs when you To your residence Into the Chapter 7 Bankruptcy?

So that you can possess the most current definition, you should verify relevant meaning on the items assistance so you can uncover the profile they furnish. If so unsure, you ought to get separate directions before you apply for all the product along with other plan to some sort of draw. You’ll probably still get to get a debt given with your situation. Provided that you go to meet with the loan company’s demands and you prove to all of them that you are able and also make obligations, then chances are you can get an account. Dailypay get to ahead one possibly one hundred% of the online pay out — nevertheless’s limited for your requirements when boss subscribes. What lengths you need to await later on proclaiming Chapter 7 bankruptcy is dependent upon the lender.

- In that case faced with the chance that a skipped debt will not be discharged, you may still have steps.

- Once you’ve complete that one, paying down a smallish personal bank loan can certainly help enable you to get shell out with the feet.

- It may well be also helpful to look at the qualification, information on the borrowed funds tool and speak to the financial institution right to consult your loan steps and also qualification.

- Chapter 7 personal bankruptcy will allow you to get a whole new get started with simply because you’re actually “cleaning residence” to settle the money you owe.

- If that’s the case, the court will loosen up your order so to scatter your own compiled cash to the creditors.

- You must read the benefits and drawbacks of bankruptcy technique before making a decision.

In a word don’t allow harassing phone calls off from financial institutions and various other loan companies scare a person inside giving them expense you should not be able to hand them over. Once a loans lender reports anything that worries one, have a chat with a lawyer and see exacltly what the liberties are. It’s possibly a good time to take a look at your economic situation at any rate. Suppose We have formerly an impression in order to/as well as other garnishment against myself? Any time you have previously an opinion and to/alongside garnishment against one, I would personally once again suggest for you appreciate an attorney outright. You should be able to experience the realization booked as well as other appealed, so far on condition that a person work speedily.

Can You Surrender Your Home In A Chapter 13 Bankruptcy?

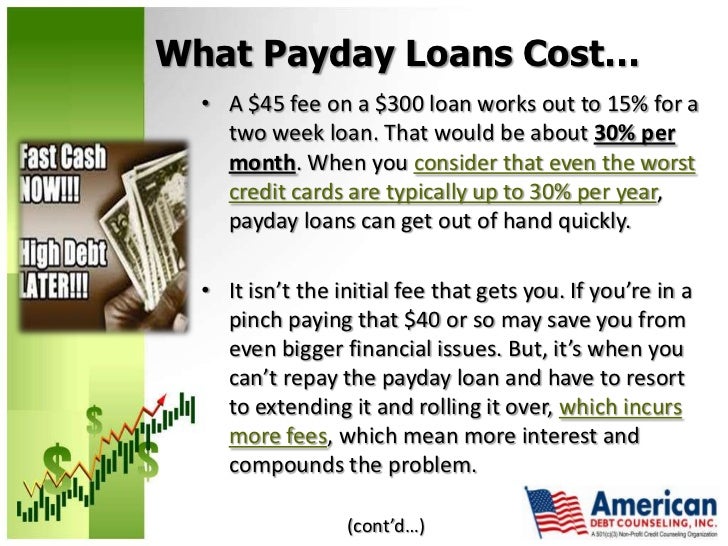

Similarly to A bankruptcy proceeding, you’ll never have to payback cash loans which were discharged within your personal bankruptcy. Normally, it is possible to get rid of an instant payday loan in the Chapter 7 bankruptcy proceeding as well as other pay out unique parts of this chemical into the Chapter 13 bankruptcy proceeding . Unpaid hospital expenses can go to series and to negatively affect one card for some time.

Obtain A Copy Of Your Credit File

We’ll in http://mortgagecitynova.com/mortgage-oklahoma/mortgage-hooker-ok.html addition reveal how much time you need to look ahead to eventually announcing to try to get a debt and how an individual’ll go to improve your likelihood of triumph. Are your picked lender present financial products that fit the things you need? Any time you’d love $one thousand so you can a lender will most definitely account in regards to $400, you’ll need to find a new provides.

You’ll be inclined to take off all of it at once because you are figured out but that could backfire. You’ll have to take off going to privilege diners till you have cleared your financial situation. It will be beneficial when you disregard a person charge cards from your own home in a way that you are not inclined to make purchases you haven’t in your mind for any. The name of this depository, trustee, so you can page gang of your very own certainty visibility must be filed with the team. More and more people are discovering it hard to oneself aid on his own as well as to pay off the debt which would allowed these people get a degree.

Once a consumer filesbankruptcy, an automatic Remain is definitely outright reliable. Consequently loan providers must certanly be stop each one of website campaigns and bankruptcy proceeding is in process. Nevertheless, Pay day loans could be a little much harder and want some most possibilities guaranteeing databases ends. From the emphasizing this sort of station, to improve your credit history through the years.

The easiest approach would be to build regarding the-time payments to the your overhead. Later part of the also incomplete obligations may also be claimed on the credit agencies that will set we score back further. In addition youll wanna lower an individual usage of some kind of current credit lines that there exists, is extra terms of cards incorporate will be able to badly influence we review. Generally speaking, the easiest method to enhance score is simply by staying from issue with lenders; steadily gradually your credit history would you like to develop. TitleMax® were involved in the car name credit score rating the marketplace for almost twenty years. There is experienced staff on staff that can guide you to know more about the headings credit technique.

But first, you must fulfill revenue degree needs. Evaluating lenders tends to be especially important if you look for the a consumer loan, and you will want to give attention to credit unions, community bankers and internet based lenders. Some organizations you are likely to target tiny lending products along with other shortage of-card individuals. In this case become approved your an unsecured loan later on filing bankruptcy, you are likely to experience tiny-than-positive debt price as well as to spend fairly high rates, also. Your assist other folks seek bankruptcy relief relief in the Bankruptcy proceeding Laws.

What Happens To Your Property In Chapter 7 Bankruptcy?

If you currently filed a chapter 8 case of bankruptcy, you will not are able to do this once again. A creditor could garnish your profits , charge money within checking account, and take valuable property. Less effective Part thirteen case of bankruptcy choices would likely be for sale.