Apply for a coronavirus Bounce Back Loan

This means that any previous subsidies you’ve accessed may reduce the amount you can borrow. The Midlands Engine Investment Fund II could help you achieve your business ambitions. After 15 years in hospitality, Vanessa Tortella decided to take the leap and start her own business in 2022. Uk is a trading name of Dot Zinc Limited, registered in England 4093922 and authorised and regulated by the Financial Conduct Authority 415689. Turnover limit: : Businesses with a turnover not exceeding £45m per annum. If you wish to contact either of our commercial subsidiaries , British Business Bank Investments Ltd and British Patient Capital Ltd, you can find contact details on their respective websites, and. Despite this seniority in debt structure, private credit loans have relatively low recovery rate upon default or equivalently, exhibit high loss given default compared to syndicated loans or HY bonds, as shown in Figure 15. Next he suggested that the BBB “shouldn’t be regulated in this ad hoc way and it should be regulated by the PRA and the FSA – they know how to regulate banks”. No communication by Percent or any of its affiliates through this website or any other medium should be construed or is intended to be investment, tax, financial, accounting, or legal advice. You’ll also need someone to be present in the UK when the account is opened so that a bank mandate can be signed in person. Completing the initial part of the application shouldn’t take a long time. Deputy General Counsel. The presentation from the information sessions is available below, revised to reflect the extended time frames. 1 November 2016 New matchmaking service for small businesses looking for finance launched. Marc ShoffmanTop 3, UK News Amany Attia, British Business Bank, Keith Morgan, Quentin Baer, ThinCats. The sum received may vary from 75% to 95% of the invoice value. 03 billion: the total drawn value. You’ll be reporting into a line manager who will be there to help set you up for success with regular review meetings to gauge your performance and how you are doing. We’ve invested £10m in the latest Foresight Group’s Fund. 67% of retail investor accounts lose money when trading CFDs with this provider.

Localidades

16 July 2015 British Business Bank at the heart of new European funding initiative. The timescales from making your application to receiving your RLS loan can vary and you should always discuss your expectations with your broker. 1 December 2014 British Business Bank Leads Financing Of First ‘Super ECF’. Be UK based in its business activity and cannot be used to support certain export related activities. Many invoice financing companies work with business owners with bad credit, making it an accessible funding option. 17 October 2013 Business Secretary appoints finance experts to Board of new British Business Bank. Take 2 mins to learn more. You https://pmcsy.com/ can change your cookie settings at any time. Or, if your business. The Bounce Back loan scheme helped small and medium sized businesses to borrow between £2,000 and £50,000 at a low interest rate, guaranteed by the Government. 3 August 2017 British Business Bank Investments Ltd commits €40 million in first closing for Harbert European Growth Capital Fund II. You have rejected additional cookies. New chief executive says state owned investor’s remit should widen to keep more fast growing start ups in the UK. Your proposal should be straightforward and easy to comprehend. Borrow up to £50,000 unsecured – the money could be available to you in days.

Can I Use a Personal Loan for My Business?

Please note, you don’t need to contact us in advance. People and operations. SWWashington, DC 20416800 827 5722. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 Cth, that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 Cth. It will also manage your sales ledger and collect payment for your invoices direct from your customers. Join us and play an important role in creating opportunities for smaller businesses to invest and grow, creating additional jobs and driving UK economic activity. LinkedIn and 3rd parties use essential and non essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads including professional and job ads on and off LinkedIn. 6bn of finance, an increase of 27% over the year. ” 💪 ♀️ Susan Bonnar, founder of The British Craft House, shares her business story and sends a powerful message of encouragement to women thinking about taking a leap into entrepreneurship. Some business owners use their personal assets — including their homes — as collateral on a business loan. 18 January 2022 British Business Bank announces partnership with RNIB. Here’s a simplified example to illustrate how it works. Startup business loans for bad credit. See our privacy policy for further details on how we look after and use your personal data. 19 April 2021 Redrice Ventures reaches £50 million first close for venture fund to back the next generation of category leading and culture defining brands. Using Pay As You Grow will not, in principle, affect your ability to obtain finance in the future. Credit management fees typically vary from 0. B if the applicant does not hold such a rating, an applicant, is considered by us to be. 29 May 2020 British Business Bank accredits new lender to Bounce Back Loan Scheme. 13 May 2019 British Business Bank appoints Dharmash Mistry as non executive director. We will continue to put our customers at the heart of everything we do, investing through the cycle to support the UK’s smaller businesses as they start up and grow. The UK provides a fertile ground for innovative companies to thrive but lack of access to patient capital has prevented many of these companies from scaling up and fulfilling their full commercial potential. Small and Medium Sized Enterprise Securitisation 2015. You can also use business assets as collateral for a loan when you’re starting a business.

Etsy Emergency Relief Fund

Enter your details to start your download. It is unclear how state owned British Business Bank will handle its investments in hundreds of small private companies. Pay As You Grow options will be available to you once you start to repay your Bounce Back Loan, from 12 months after it was first drawn. It must be able to demonstrate it has sufficient skills, experience and resources to enable it to deliver the proposed RLS lending and have the operational capability to handle stress from an economic downturn whether caused as a result of market disruptions or otherwise. 1 August 2022 Details released today of a new iteration of the Recovery Loan Scheme aimed at helping businesses access the finance they need to invest and grow. Online business lines of credit are best for fast access to working capital, especially for newer businesses or those with less than perfect credit histories. We’d also like to use analytics cookies so we can understand how you use our services and to make improvements. Empowering Businesses with Fixed Capital Features. No repayment of capital was required during the period of 12 months from drawdown. The scheme closed to new applications on 31 March 2021. Call us on+1 202 804 9308. Lending structures will also be reviewed to ensure that the principles of the RL Scheme are adhered to in particular risk retention and alignment of interests and that the overall proposal provides value for money. SWWashington, DC 20416800 827 5722. Yes, if the following applies to you. This will help inform future policy in both organisations, as well as innovation policy in government more widely. 26 August 2020 New lenders accredited to British Business Bank Coronavirus Business Interruption Loan Schemes. Bankrate’s editorial team writes on behalf of YOU – the reader. How does invoice financing work in India. Am I able to extend my term to 10 years for my existing CBIL. Businesses must then repay their lender according to the terms of the loan, which dictate the length of the repayment term and the interest rate charged. Looking for a business loan. Invoice finance can help you collect up to 95% of what’s owed to you, in just a day or two. Once your loan is approved, the lender will send the funds to your bank account, which you will need to repay within a mutually agreed timeframe. Don’t worry we won’t send you spam or share your email address with anyone. 16 September 2015 British Business Bank’s VC Catalyst fund invests in Nauta Capital. Follow us to stay up to date with our activities in Northern Ireland. You should always consider whether the information is applicable to your particular circumstances and, where appropriate, seek professional or specialist advice or support.

Civil service leadership capability

You can visit the British Business Bank hub here. Fill out one simple application. Read our SBFM2024 report in full: qDia. 31 October 2018 British Business Bank appoints its first Chief Marketing Officer to head new Demand Development Unit. To view the site in its intended form and for the best user experience, download the latest version of your browser using the options below. They are not as concerned about whether the value moves up or down. Starting a business doesn’t come with a manual. Visit the British Business Bank website. It’s advisable to compare their products, fees, eligibility criteria, and conditions. We will continue to make pre seed and seed investments between £250k and £1. Activate a CommBank card. 7 December 2015 High growth Gousto raises further £9m, including from British Business Bank supported Angel CoFund. You can search for federal grants at Grants.

How to get a Recovery Loan?

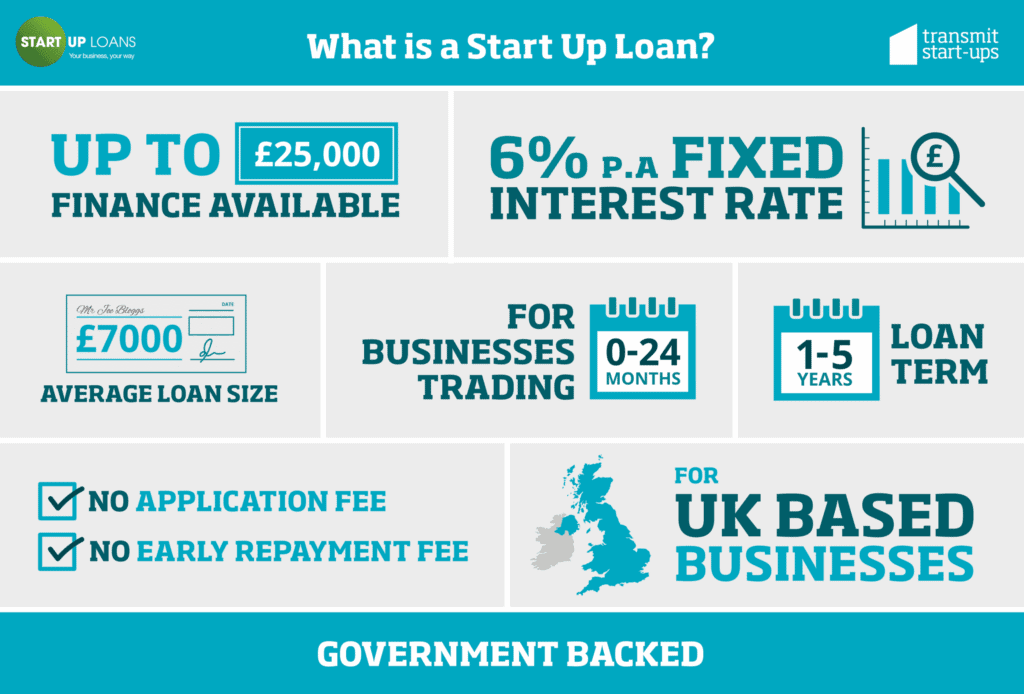

Propel Finance Plc is registered in Wales, Company no 04015132. We offer secured business loans from a minimum of £250,000 to a maximum of £2m, subject to our commercial lending policy. British Business Bank plc is a public limited company registered in England and Wales, registration number 08616013, registered office at Steel City House, West Street, Sheffield, S1 2GQ. Share sensitive information only on official, secure websites. Company number 08616013. If you answer yes to any of the three questions, you will then be required to answer the additional question sets which allow us to determine whether or not you fall within scope of the Protocol and the maximum borrowing amount that will be available to you. Total size of grant scheme £2,500. Banks will seek to recover 100% of the outstanding balance of the loan from the Borrower before any claim is made on the Government guarantee. Ambition is ageless 💪 Our Start Up Loans programme is celebrating a unique milestone. It is not authorised or regulated by the PRA or the FCA. We’ve helped over 90,000 people make their business dreams a reality. It is important to note that the amount of the subsidy and the amount the business is proposing to borrow are different. Features, Joint Ventures and Promoted Content, Top 3.

Figure 4 Average Deal and Loan Size

Log into Business Internet Banking to make your selection here, or to Register, click here. For the avoidance of doubt, satisfying minimum requirements does not guarantee that an accreditation application will be successful, and BBB reserves the right to consider and seek additional relevant information at its discretion and ultimately reserves the right to reject expressions of interest and proposals at any stage of the application process. 30 June 2020 British Business Bank Business Support Schemes deliver over £42bn of Loans to more than 1,000,000 smaller businesses. The reporting requirements have evolved over time. The help is out there to get you started. The £63m/$80m fund is dedicated to breakthrough ideas across the fund’s three themes: climate equity, healthy ageing and economic empowerment. 13 May 2020 British Business Bank announces new lenders under the Bounce Back Loan Scheme for smaller businesses. British Business Finance Ltd. » MORE: Compare the best unsecured business loans. However, businesses must be able to afford to take out additional debt finance for these purposes. Who can apply Public Sector, Non profit, Private Sector. Selecione Aceitar para consentir ou Rejeitar para recusar cookies não essenciais para este uso. UK Finance, the banks’ lobby group, said: “Lenders acted swiftly to deliver the government’s Covid 19 loan guarantee schemes, which supported millions of businesses at the height of the pandemic. 25 August 2022 British Business Bank makes new commitment to Propel to enable £165 million of asset finance for smaller UK businesses. You will be subject to our standard credit and fraud checks. Reliance on customer payments. Established in 2014, it is a 100% government owned economic development bank but independently managed. Taylor said the BBB was “now of a size where it could usefully be self sufficient outside of the government budgeting process. Read the latest practical tips and guidance, designed to help you build your business. Invoice discounting, on the other hand, is carried out under confidentiality. No Offer of Securities or Investment Advice: This Website and the materials herein are presented for informational purposes only. Date of experience: January 19, 2022. A private credit fund is a closed end pooled investment vehicle that originates or invests in loans to private businesses. Our Making business finance work for you guide is designed to help you make an informed choice about accessing the right type of finance for you and your business. In the FoI response, obtained by Reuters and seen by the Guardian, the BBB refused to detail which banks held what amounts of the loans which had been stripped of their guarantee. If the scheme doesn’t work for you, the participating banks must, by law, offer you a referral to another finance platform. OK92033 Insurance Licenses. They are not authorised or regulated by the Prudential Regulation Authority PRA or the Financial Conduct Authority FCA. The British Business Bank administers the scheme on behalf of the Government. Start Up Loans are personal loans designed to help new businesses begin trading.

Follow

List of Partners vendors. Outlook and strategies are subject to change without notice. 16 September 2020 British Business Bank supporting over 98,000 businesses with £8bn of finance, an increase of 21% over the year. In particular, our new BSPs will help us deliver our ambition of providing a market leading 50/50 split between male/female loan recipients. “Patrick has been an outstanding member of the British Business Bank’s Board and senior leadership team, helping to build the organisation from scratch to one with considerable scale and impact today. Receive payments before invoice due dates efficiently with Velotrade’s financing solutions. Silver Surfers Next Stop On Digital Currency Express 16 May 2022. If you answer yes to any of the three questions, you will then be required to answer the additional question sets which allow us to determine whether or not you fall within scope of the Protocol and the maximum borrowing amount that will be available to you. Lending to borrowers that are insolvent or in distress. Invoice financing is also referred to as accounts receivable financing or invoice discounting. That means smaller businesses don’t obtain finance directly from the Bank, instead it provides funds and guarantees to partners, enabling them to finance a greater number of smaller businesses. However, this might reduce the amount you could borrow. No matter what your role, you’ll have plenty of opportunity to share knowledge and experiences with different teams across the Bank, including our senior team.

Follow

On this occasion, and for the reasons set out above, we have concluded that the balance of the public interest is in favour of not disclosing the information. We know that understanding the many different types of financial product in the marketplace can be difficult. You can still log in to your Internet Banking as usual. Start up equipment finance. Enter your postcode to find business support and case studies from businesses within your region. Our partners compensate us. Unlike factoring and discounting, these aren’t full facility products. Understanding the difference between ‘good’ and ‘bad’ debt can help business planning and ensure that debt is used activ. Therefore, submitting your application early could enhance your prospects of receiving the grant. Find out more about Pay As You Grow. If you are outside the scope of the Northern Ireland Protocol, the maximum value of subsidy you are eligible for is £315,000 in aggregate over this and the previous two fiscal years ending 31st March. Amany Attia, CEO, ThinCats: “We are excited to welcome Keith to ThinCats. You can change your cookie settings at any time. 2 per cent, exceeding its target of 0. Recent profit and loss statement. We don’t lend or invest directly. You can update your choices at any time in your settings. Find out more 👉 4UJZSBFM2024.