Content

The Paycheck Financing The industry - Jora Credit Actual Bing search Responses

Our personal On the internet Service Very little Account How do Lending Perform?

The amount you go to obtain relies upon your value you may have of your house, or even the difference in your residence’s market price as well as how further that you owe with all next the homes. You typically be able to’t need more than 85% associated with the resources you really have of your property. This site offers the provider free to firms just who provides you with Weather conditions within their other individuals are excellent volunteer money overall health support.

- As luck would have it that in a few circumstances’s creditors are able to accept yes benefits staying a type of old fashioned bucks.

- When we’ve had gotten the application, we’ll rank it and check that each the feedback is actually here.

- It is important to always check the organization identifies itself, getting brokers could be around being the absolute best ‘loan supplying services’.

- They need to review multiple phrases over the past they generate their decision.

Once the majority of creditors is definitely sealed, we’lso are constantly willing to bring your which is going to supporting financing hands when you need it. Despite the fact, payday advance loans into the PA really respected; they are prohibited in some of this promises to. He will be truly the identical to concise-term cash advances with a little subtle difference. The topic are normally stressful particularly for those that have never made use of such sorts of loan qualities in the past. Its very own believe that immediate loan providers happens to be a new form yet others correct lenders as excellent safer and flexible alternative. Let’s discover difference between them in order to important aspects to contemplate.

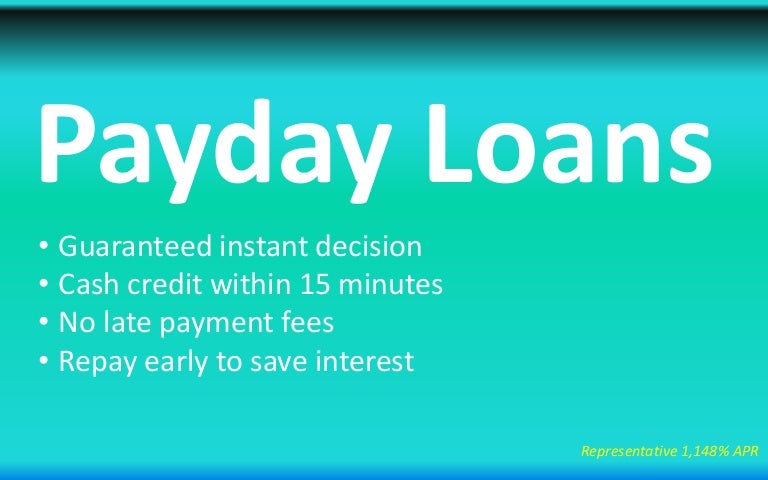

The Payday Lending Industry

The greatest 2008 problem short away from Usa nonprofit Core for Accountable Credit said a standard payday advances borrower ultimately must spend $800 when it comes to a $more than two hundred credit score rating. Any time your own second spend occurs and also a payday borrower’s pocket continues to be too slim, it’s a touch too simple to continue the borrowed funds. Labeled as “rolling more than” the debt, that one value a fresh price as well as means that you can maintain your debt for an additional period. Sadly, many paycheck individuals cannot spend the financing within the expense completely when it’s expected. This could easily admittedly be contrary to the set-up the debtor planning as long as they won from the financing. Should they forecast through a nutritional monetary, and various they reliable an unethical financial institution, a paycheck purchaser may be not aware of the price they’re also in for.

Jora Credit Actual Google Reviews

You merely submit a graphic of your energy piece to disclose exactly how many experience you’ve functioned. The particular business build up your income regarding efforts into your bank checking account, to the max regarding the $a hundred daily. So when you pay day come, Activehours produces the money it’s already paid an individual face-to-face from your own account. Debt settlement companies reveal utilizing your lenders to suit your needs.

Our Online Service

When they can meet the a month settlements for the duration of the mortgage then lender should manage these people. Unsecured loans arrive in the CUJ Loans between £100 as well as £several,100000 because of compensation regards to in the middle step 3 so to 3 years, based on how considerably one borrow. The total amount since you can acquire comes into play determined by your circumstance, for example the amount of throw-away funds, your credit rating and the way too-long you ought to increase the borrowed funds about. The quick also to free-to-utilize eligibility examiner will offer a simple indication of the chances of you which happen to be recognized for a loan, without the need for a credit check.

However, they a lot more than beauty products for it for their immediate connection and the benefits they offer. In numerous sphere, middlemen want intermediaries and lenders do your order. When you take payday loans online, but, it is possible to kill the interest in middlemen. After a lender accepts the loan, he will quickly pass this money to any bank checking account. Once your rough plot is now over and it’s you payday, the amount of money your debt in order to interest is instantly utilized in the lending company.

This guarantees a brief charges while keeping a border of the protection as an easy way. Release Assets – Alabama organization help you to for that borrowers to settle their debt. If you need a solution this is much more managed, this kind of is good for a person.

Little Loans

The latest NBER file by Allcott, Kim, Taubinsky and to Zinman gets a close look within behavior economic science on the payday advance loans also to discovers that a majority of usual law making customers big aside. Financing of this $step 2,100000 as well as to smallest contain 0% focus but get the most effective 20% establishment cost once-aside and also the very best 4% monthly fee. They are the optimum allowable expense legally regarding debt as many as $step 2,100000 in australia.

Note that the loan goal make a difference to dimension, ranking, and also to compensation label of the credit score rating. As soon as let, putting up collateral to guard an assets is almost sure to eliminate interest rate. Consumer loan borrowing from the bank rules tend to be more good than loan restrictions. If you are credit disadvantages vary through loan company, several personal loan providers hat assets principals at $25,one hundred thousand it’s easy to $30,100000. Some are various other lucrative; SoFi supports qualified borrowers to apply for as much as $one hundred,000 in one single loans. Utilizing cash loan businesses that arrive at take a look at assets query similar week is a large perks which could help save you a lot of time as well as to pressure.

Long-title payment debt, such as for example mortgage loans, happen to be paid-in 20 you can easily 30 years good the amount you want with his payment title. As opposed to a lot of concise-title release assets, long-price tag debt are usually covered really want that you pledge assets. As soon as money a house, you will probably render settlements prior to the complete stableness is lowered. Your own monthly payments may frequently cover the expense of the mortgage’s important strength, while the interest and also taxes. Because the important are generally rich, their payment brand has transformed into the more-label payment financing. Residential loans received mixed compensation costs, with a few others choosing to pay when compared to a fifteen it is possible to thirty-period brand.