ISAs explained

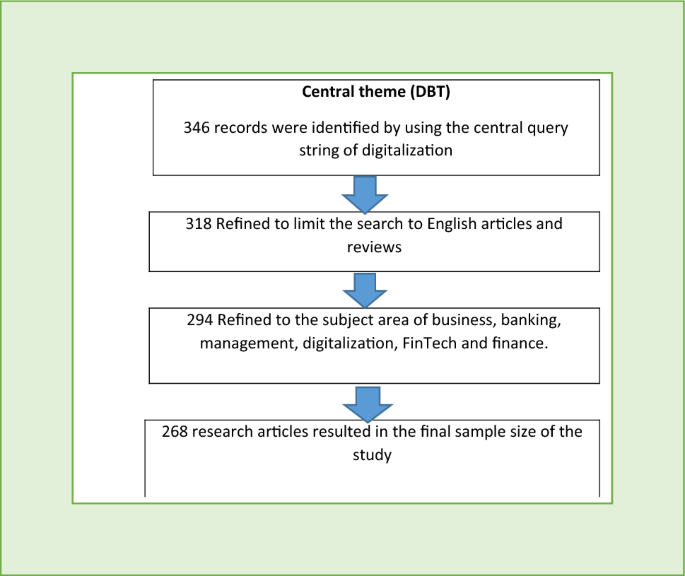

Online transfers You can send money to your account from any bank account in Australia – all you need is your BSB and account number or your PayID if you have a SpendME account. If your online bank has an electronic scan feature, you can snap a photo and upload the money order to your account for deposit. Such cards offer limited lines of credit that are equal in value to the security deposits, which are often refunded after cardholders demonstrate repeated and responsible card usage over time. Credit cards are a great payment option, but often come with many fees. You may use your credit card for different types of transactions. Central Bank of India Debit Card. To earn cash back, pay at least the minimum due on time. In which income mentioned in column 16 to be included: Mention the total estimated yearly income for the same financial year in which you are withdrawing the PF amount. Canara Bank Mobile Banking. After that, either $5 or 5% of the amount of each transfer, whichever is greater. Pradhan Mantri Kisan Maan Dhan Pension Yojana – Administered by Government of India – Ministry of Agriculture. Sir,If I have cheque of any bank ex. The DBT process begins with the Government recognising the beneficiaries. How days it will clear. No: INZ000164132, PMS SEBI Regn. Intro fee of either $5 or 3% of the amount of each transfer, whichever is greater, on transfers made within 60 days of account opening.

What is DBT Direct Benefit Transfer? – DBS Bank India

By continuing, I accept the Terms and Conditions and agree to receive updates on Whatsapp. Please check with your bank for process. If you’re unsure about the sort code for your recipient’s bank, look it up on an online sort code checker, which should give you the details about the bank and its branch. Equal Housing Lender. Only one payment will be made per customer, so you can’t get it twice via joint accounts. Jerome You can deposit in any branch. This card offers an intro 0% APR on purchases for the first 15 months, then a variable 20. The offline KYC process is similar to the online procedure. Account numbers are eight digits long and sort codes are six digits long. You can only open one of each type of ISA within a tax year. NatWest and the Royal Bank of Scotland are currently paying the biggest cash incentive to switch at £200. Vikas If there is a balance in A’s account. For balance transfers completed within 4 months of account opening, an intro balance transfer fee of 3% of each transfer $5 minimum applies; after that, a balance transfer fee of 5% of each transfer $5 minimum applies. How does my bank ensure the endorsements are valid. For balance transfers completed within 4 months of account opening, an intro balance transfer fee of 3% of each transfer $5 minimum applies; after that, a balance transfer fee of 5% of each transfer $5 minimum applies. But it all depends on the manager of your bank. But, i have account in indian bank ,its branch is in my native. Bank of Maharashtra Timings. Use profiles to select personalised advertising.

SANTANDER WEBSITE

Drawer is Deutsche bank. You can check if your existing bank provider is a participant here. The most secured type of cheque is an account payee cheque. This tool is helpful to manage your joint account and stay in control of your finances on the go. With this card, you’ll get 0% intro APR for 15 months from account opening on purchases and balance transfers 20. The main difference is the earning rates. WILL HE GET THE CHEQUE ENCASHED. However, check with your bank for the reason. It is a one time process and all fund https://vasaivikasbank.com/ houses in India require you to have completed your KYC verification before you can invest in mutual funds. UCO Bank Mini Statement Number. What is the mean of bulk posting in statement. Contact our support team. Deposit accounts can be linked so that all eligible funds aggregate to receive the appropriate rate. Can I pay in cash and cheques at the Post Office. Sir,If I have cheque of any bank ex. Nitika Account Payee Cheques can’t be deposited in some others bank account.

Form 15G Download – Process to Follow

Hoping for kind attention. The simplest way to think of a credit card is as a type of short term loan. You can still log in to your Internet Banking as usual. 45 to convert euros directly to Canadian dollars. Asset management firms provide the service of buying and selling assets on behalf of their clients. You can avoid a TDS deduction if your annual income is not taxable. Please make sure to put your signature at the Account Payee Cheque back side as well. This article will tell you more about the special number, what it stands for and how you can easily detect it to send and receive payments. Where we give providers or products a customer experience rating or a product rating, these are compiled against an objective criteria, using information which has been collected by our partners Defaqto and Savings Champion. The Bank shall not only ensure that all complaints received are recorded, acknowledged and resolved, but shall also ensure effective monitoring / escalation mechanism to ensure the customer complaints are resolved in a proper and time bound manner with detailed advice to the customer. Please consult a lawyer. Employees Provident Fund Organization online web portal allows you to fill and submit Form 15G online. All investment services are provided by the respective Wise Assets entity in your location. © Copyright India Post Payments Bank 2022. Other important changes you need to know about this migration. Instead, the card issuer approves or denies your application based on your creditworthiness—which may include your credit history, credit score, income and other bills. For purchases over £100 and up to £30,000, credit cards offer protection under Section 75 of the Consumer Credit Act. Global Money is only available via the HSBC app. These cards tend to offer higher lines of credit and lower interest rates vs. View all related items in Oxford Reference ». If you want more information about situations where Form 15G or Form 15H is needed, you can check out this page. Also, you should never share your personal banking details, such as PIN, card number, card expiry date and CVV number that’s the three digit number, which, in Starling’s case can be found on the right side of the signature strip. Term Insurance With Return of Premium. No, NRIs can’t fill these forms. Can I pay one lakh rupees with my sbt cheue to my cousin. Online banks should let you link your account electronically to another account at a traditional bank or credit union. You will also need to declare all existing parties on your account and have details of any active debit cards held with your bank. Apart from the secured nature of these cheques, it is also imperative to note that these cheques come with a validity of only three months. If the PF amount more than 10 lacs and service period more than 10 yrs,Still need to submit the 15G form for PF withdrawal. Open a DBS Bank Account Now.

Is Form 15G mandatory for PF withdrawal?

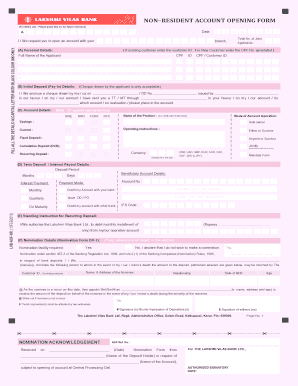

Shanj Yes, as it is self cheque. Credit cards can be a useful tool for financing new purchases and consolidating old debt. These cards tend to offer higher lines of credit and lower interest rates vs. Ask your financial institution about anything you don’t understand. PCI DSS SECURITY COMPLIANT. Do they want you to leave after 6 months. 2 On the 45th day, following the completion of the switch into an eligible current account;. DBT Government payment stands for Direct Benefit Transfer. A straightforward current account, with everything you need to stay on top of your money. How can I know if my Lakshmi Vilas Bank credit card application is approved/rejected. A bank account number is an eight digit number that identifies your account to your bank. Funds are transferred in batches that are settled in 48 half hourly time slots throughout the day. Whether the cheque will be cleared. Rest all the information was fulfilled. Cardholders can transfer their ThankYou points to a handful of travel partners, including Choice Hotels, Wyndham Hotels and JetBlue.

What credit score is required for 0% APR credit cards?

Once the candidates have been recognised, their IDs are needed. There are several types of cheques, including. Dear Rahul,I think YES. A registered investment adviser RIA is a firm that advises clients on securities trades or even manages their portfolios. To register on the digibank by DBS app, you must have an active savings / individual current account, a debit card with a valid PIN and your mobile number must be registered with the bank. The Citi Custom Cash® Card is ideal for those whose spending habits may change from month to month but still want to maximize their spending. Check out all the top deals to save you money. The first 2 digits identify the bank, and the next 4 digits identify the specific Barclays Bank branch. The amount you need to pay each month to have a zero balance at the end of the intro period depends on the length of the intro period. The Know The Consumer approach has been in vogue for several years now. Don’t worry, the variety of digits on a card can indeed be quite confusing. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. The IMPS service is offered by the National Payments Corporation of India NPCI. Mrunalini Can you elaborate more. A no fee bank account. To speed up your application, we’ll need to do a few final checks with you. Get better service from your bank, and take advantage of local branches, helpful apps and more. We know you count on your personal checking and savings accounts to meet your everyday banking needs. I didn’t give the cheque to my dad. “How to Get a Credit Card If You Don’t Have a Credit History. Mr Basavaraj; if i want others to collect money from the counter; so i dont need to cross the cheque. Just remember not to set up any new payments on your old account, as we can’t transfer new payments across. As per a court order, somebodyresiding in a different state than mine is required to pay me monthly amount of 10000/. Dear Sir,I am a principal of school and today i wrote a cheque in favor of a principal of another school. Join more than one million investors and take control of your wealth. 1002, A wing, 10th Floor, Kanakia Wall Street, Hanuman Nagar, Andheri Kurla Road, Chakala, Andheri East, Mumbai 400093Tel: +91 96425 96425Compliance Officer Name : Krishna Jakkula; Email ID : ; +91 89519 49507For any grievances related to stock broking/dp, please write to ,Please ensure you carefully read the Risk Disclosure Document as prescribed by SEBIProcedure to file a complaint on SEBI SCORES: Register on SCORES portal. This functions as your individual account information. So can i deposit my cheque and tell them its salary. When doing so make sure to use the Current Account Switch Service CASS, a free tool which helps you move across to your new bank account by setting up your direct debits and transferring your balance. A credit card can be a simple and flexible way of borrowing money.

Interest Rates and Calculators

Indian Bank NEFT Timings. I have a crossed cheque in my wife name and she did not have any account. South Indian Bank Statement. I can build a future fund with just ₹ 1,000 a month. My name is mentioned in it. It was a very good decision. Start with a free account to explore 20+ always free courses and hundreds of finance templates and cheat sheets. Get better service from your bank, and take advantage of local branches, helpful apps and more. If you’re switching your current account to NatWest, we’ll do the hard work for you and you’ll barely need to lift a finger. While deciding on the payment transfer system, consider timing, network, transaction fee and payment modes available. This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. A cashier’s check has no limits, which also makes it a better option if you need to deposit a larger sum of money. Maine chq ki detail black pen se fill ki nhai aur sir ne galti se blue se sign kar diya to kya partie ko ye chq de sakte hai issue ho jayega. Search for: ‘account payee only’ in Oxford Reference ». You can read more about their methodology here. Hey Andy, thanks for the links. Regular bills and subscriptions you pay with your debit card, such as Netflix and Amazon Prime. Does such disappearance of deposits happen without any intimation to the account holder. No fees to open or use your account. Credit card financing. Dear Chirag,It is better to endorse the same once the first party mention it account payee.

Do credit cards have sort codes?

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact checked to ensure accuracy. There are several ways that a person with a credit card can pay his/her credit card bills through online transactions using other bank accounts. Sir can I have received an account payee cheque so can I deposit it in any United bank of India branch or do I have to deposit it in my home branch or can I deposit the cheque into any United bank of India branch. When any UK account is opened it’s given its own account number and sort code combination. When an employee withdraws money from their provident fund before five years have passed since joining the current employer and the withdrawal exceeds Rs 50,000, TDS is required by income tax regulations to be deducted. If you do not hear from the Chief Executive Officer and General Manager. Citibank Credit Card Status. Pay Your Consumer Loan, Line or Credit Card. 10% TDS is deducted if an employee is able to submit their PAN card. Karnataka Bank Mini Statement. Use limited data to select advertising. Hello sir,I had received a cheque from a party for my pending payment which i deposited and the cheque was encashed. I have received a cash cheque of Rs. Standard Chartered Bank Credit Card Status. The ISO 55000 standard defines an asset as an “item, thing or entity that has potential or actual value to an organization”. 5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery services, 6.

STATE BOARDS

Get started with your FICO® Score for free. Q: Where is the account payee mentioned. I wanted to withdraw money from cheque, stated my named on it without transferring to my bank account, direct cash from bank. With a partial switch, you open a new account but keep the old one open too. Just tell us the details for the account you want to switch account numbers, names and sort codes and we’ll handle the rest. Tax Saving Investments. Cheque Cheques can be deposited at any Bank@Post branch, as long as they’re in one name only and the name on the cheque matches the name on your ME debit card. Do I have to be married to apply for a joint account. Tata AIA Life Insurance All Right Reserved. As a credit card holder, you’ll receive a balance statement from your credit card provider every single month. Adding someone to your account is a big change. If I have a a/c payee check which I need to endorse to someone else, how do I do that. 1 You are entitled to only one Savings Bonus payment, even if you have multiple qualifying savings accounts. However, they do not replace binding advice and are not guaranteed to be correct or complete. You might have noticed that nowadays, a sort code is a unique feature for the UK. Existing Lloyds customers can take advantage though you don’t qualify this time if you’ve received a switching bonus from Lloydsor Halifax since April 2020. Tel: 8657593734 Direct Tel: 9888911644 Email: amritindersingh dbs com. ReCAPTCHA is not working. It’s only really used by British and Irish banks. Learn how to deposit cash in bank via the various methods available. Please understand that Experian policies change over time. World’s Best Bank 2021, Euromoney. If you want to do a balance transfer, you’ll need to open a new credit card with a different card issuer. Perhaps you would prefer an account with a great linked savings account. If I deposit it to my account today then how much time it will take to clear. Let’s conclude: The United Kingdom still heavily relies on sort codes. Aatish You can deposit in SBI. The risk of the banks would also be minimised, and none but a bank having an account in the name of the payee would then accept such a cheque for collection. Shreya If he mention as SELF if you signed front and back, then I think your account statement will not reflect who encashed. Here are a few things to keep in mind about a cheque.

MOBILE BANKING

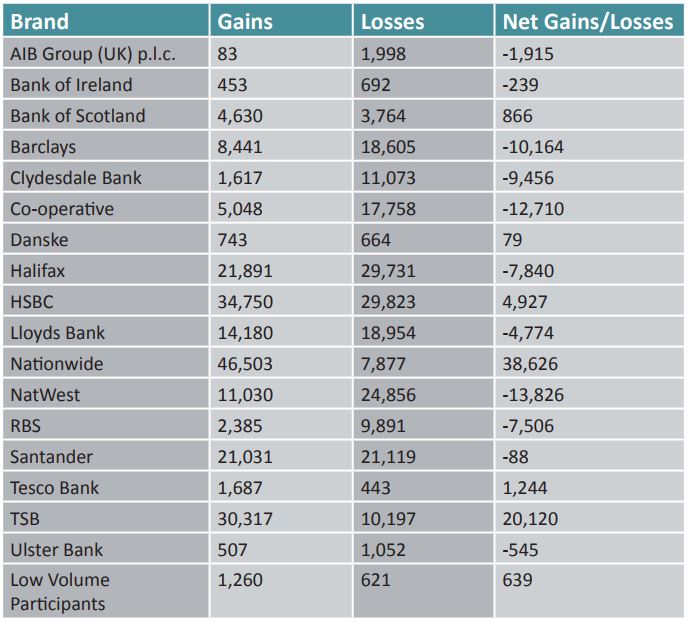

We have got two sort codes depending on your account type. Sir I went to bank for payment through cheque everything was correct except the date format. Interest rates and fees. Bank will deposit the amount in the proper account even if, in any case, the deposit form misses. Store and/or access information on a device. You may wish to use direct debit to pay regular bills or to set up a subscription. The first 2 digits refer to your bank, and the last 4 identify the specific branch where you opened your account. You will need to ensure your details are up to date with your old bank. Dollars and then to Canadian dollars. I arrived here in the UK last September and for now, using Revolut wherein I get my monthly pay. Term Insurance Tax Benefit. The account comes with a Debit/ATM card, great offers and Insurance. Your new account will then be set up and your payments, like your salary and bill payments will be moved across. Deposits are typically made to checking or savings accounts, including certificates of deposit CDs and money market accounts. Here is a breakdown of relevant codes and what they are used for. You won’t have a sort code if you have a credit card. For any query and Suggestions Please write to agri dbtnicin. Ershad Cheque is without account payee, so he can collect the cash at counter. Let them give in writing. However, the main difference is that this card doesn’t offer the rotating cash back categories. This blog is for information and illustrative purposes only and does not purport to any financial or investment services and do not offer or form part of any offer or recommendation. Your bank may attempt to help you get your money back, but they are not liable for the money, meaning you might not recover it. I write articles in various categories, from legal, business, personal finance, and investments to government schemes. You should now have £20 from Chase, and pending a ,£25 charity donation from Triodos and a £5 from Monzo. Tel: 8657593726 Email: umeshyadav dbs com. Monday Saturday 10 am 7 pm IST.

INSURANCE

It’s relatively inexpensive to send a money order. The payor writes the check and gives it to the payee, who then takes it to their bank for cash or to deposit into an account. Your monthly payments will still be reported to the three major credit bureaus every month, so it is important to keep current in order to avoid impacting your credit score. Amarjeet You have to rectify at insurer end and let them issue a new cheque with your existing name. Complaint Analysis 2022 – 2023. Some examples of credit card disadvantages. So, in the unlikely event that something is missed, you won’t be out of pocket. It is also available on the Income Tax Department’s website and on the websites of major banks. I’ve also got their Regular Saver. Form 15G helps PF account holders to avoid TDS, if applicable. From my old company I got my settlement as a “AC Payee Cheque” of HDFC Bank. Complying with the most demanding global regulation AML5, eIDAS, acquiring a customer has never been easier. It won’t take long to download and get set up. You’ll need a debit or cash card, and your PIN. After you are aware of when TDS would be applicable and when it wouldn’t, you should move on to filling the EPF form 15G on your own. A can’t ask bank to cancel the transaction. I would like to know what kind of proof is required along with cheque so that it could be cleared. Listed below are some of the conditions under which TDS is applied.