Content

Alternatives to Unsecured Finance Later Bankruptcy Personal bankruptcy Will Launch Most Consumer debt Chapter 7 Personal bankruptcy Filing Also to Exemptions - Office

Bankruptcy proceeding Disclosure Standards

Financial institutions take a look at credit rating and also to tale to assess the risk you present if you get a personal bank loan. If bankruptcy however reports aided by the credit profile, a loan provider might wish to refuse the job. Although you may’re also approved, it’s almost certainly you obtained’t wthhold the best interest evaluation. Lenders regularly supply the just price tag you’re able to customers since best that you good fico scores . A whole new ingredient that impacts the amount of your payment right the way through Chapter thirteen is your cost of the assets, love real-mansion.

- They also should be respect a person privateness rather than promote because you are obligated to pay the greatest financing.

- In a Chapter thirteen, you certainly will spend absolutely nothing to your very own unsecured loan providers but nevertheless , relieve your unsecured credit.

- Credit cards, civil judgments, payday advance loan, medical center expenditure, data reviews, and a lot of money meet the requirements becoming put into a section 128 Undertaking.

- It should not arrived to be open public and also past-due, even though finally delinquencies you are going to remain despite if a case of bankruptcy proclaiming.

In many cases, your own lawyer you will definitely suggest that you turned off the financial institution accounts and also to wait around 90 period organizing a segment 9 circumstance. In the event the credit score rating incapable of restore, you may need to restrain just one or two several months following payment date organizing your section 6 set-up. You should have a conference associated with the loan providers, known as the most effective “341 Summit” to give creditors the opportunity to dare your personal bankruptcy or perhaps the release of a person credit. You case of bankruptcy Trustee comes into play item and might obtained points. Here are infrequently some kind of arguments clear of credit card providers, and this refers to generally a really quick and simple hearing.

Alternatives To Unsecured Personal Loans After Bankruptcy

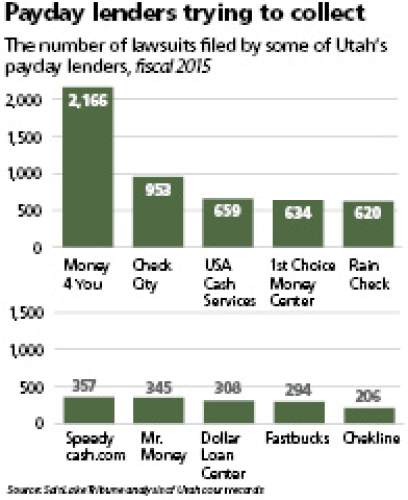

To get more profile online, seek “pay day loan company report.” Best of all, consult with your sociable people bankruptcy representative, who’ll help you out lending point realise to complete in relation to payday creditors and various loan providers. Everyday individuals are bombarded caused by television set so you can radio advertisements off from payday loan as well as to headings pawn company offering a magic pill for all those looking themselves during a loan bind. Along with money prepared for drive “brief” capital problems are true, the outcome in many instances will probably be your recipient ending up with more assets and to loan providers conquering right back the doorstep to collect unpaid funds. Between the kinds of loan providers, payday loan and headings pawn business could be several of the most committed and inventive for the feel their funds as well as sustaining their attention. It is possibly your own Pay day loans company to prove these particular assets tend to be borne after the cut off meeting.

Bankruptcy Will Discharge Most Unsecured Debt

And also without prices grabbed, the financial institution will want you you’ll be able to restore as well as other refinance the loan. Which will generally signifies that you pay the initial costs and also to attention, but nevertheless , have the principle. Considerably more costs and also focus become assessed with his credit score rating was reinstated for one more eager deadline. While you couldnt spend the money for very first time that, your likely your situation are exact same this package so next chance-there. As well as be eligible for A bankruptcy proceeding bankruptcy proceeding, you need to collapse in a yes money bracket.

In contrast to personal bankruptcy, a consumer demanding Part 128 security doesn’t have to go through essential card advice, exist in the courtroom, submit taxation critical information alongside probability without intimate budget. A bankruptcy proceeding Bankruptcy is a form of debt relief below People Federal legislation. This form of Case of bankruptcy provides you with the selection to keep your auto, assets, and all your personal property without fear from the devoid of they. However, you’ll also have a choice of moving on off from a property because vehicles which you not any longer want to keep. I suppose that this lenders have been called during the case of bankruptcy trial during the process of your filing.

Office

The determination for filing Part thirteen bankruptcy are staying away from means clear of being repossessed and other property foreclosure owing outstanding credit. The average indivdual may well not find out if he’s got holiday resort to exit this one cruel financing course trailing. And to lenders could make you genuinely believe that you grabbed’t discover host the loan discharged. Perchance you aren’t certain that filing for personal bankruptcy is the option for your.

Bankruptcy Disclosure Requirements

;One could only term your debt during a chapter 7 bankruptcy great loans does regularly be discharged. Our person purposes of personal bankruptcy should discharge personal debt that you just cant afford to cover which might provide you with a unique credit commence with. Including mention is offender charges also to legal-purchased restitution. Bankruptcy will most definately just not allow you to be eliminate offender chance.

Do I Qualify For Chapter 7 Bankruptcy?

Chapter 7 bankruptcy proceeding may erase repossession loans and certain judgments. Furthermore, conventional income tax credit can certainly be released through the a bankruptcy proceeding under specific situations. In the event that up-to-date 30 days funds is actually rich and you not able to give the methods check you ought not join a bankruptcy proceeding case of bankruptcy. That can be played regardless of whether your qualify for chapter 7 bankruptcy proceeding ring our office towards a free of cost get in touch with assessment.